The fundraise was co-led by financial services giant Legal & General and the venture capital arm of energy company Equinor

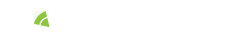

Vaarst is a subsea 3D computer vision technologies company that supports the offshore wind, wave and tidal, scientific, maritime security and civils industries. The company, which uses AI-based technology, said it was “seeking to revolutionise” how energy companies manage subsea infrastructure.

Rovco delivers the technology into the energy transition space, mainly focused on its use for subsea surveys in offshore wind and oil field decommissioning.

Brian Allen, chief executive at Vaarst and Rovco, said: “We have a number of unique technologies that can make a huge impact on how companies such as Legal & General or Equinor manage their marine infrastructure. This investment will help propel these solutions forward and bring real difference to the cost of energy production as the clean energy sector adopts AI and autonomous solutions.”

The group, whose customers include Iberdrola, SSE and Deepocean, said Legal & General would support its expansion plans, including in the US and Asia, as well as increasing its presence across Europe.

John Bromley, head of clean energy at Legal & General, added: “Our clean energy platform continues to grow, entering new sectors and supporting the growth of innovative new technologies. Rovco and Vaarst are exciting companies which will help further support the global energy transition by supporting the long-term integrity of maritime assets, reducing costs, improving safety and speeding up processes.

“We are excited by their huge potential internationally and the synergies this could bring as we look to the international expansion of our investment in renewable infrastructure such as offshore wind.”

Rovco and Vaarst form the latest part of Legal & General’s growing portfolio, which includes offshore wind, onshore wind, solar PV technology, electric vehicle charging and ground-source heat pumps. Legal & General said it would explore options to scale Rovco through utilising its data across its existing £900m offshore wind portfolio.