Saab’s Seaeye SR20 electric work-class ROV completed a period of water trials in October 2024. Saab photo.

Remotely operated vehicles, or ROVs, are the underwater workhorses of offshore energy production, tethered from a vessel or rig and deployed deep beneath the waves to perform essential functions in environments that are too dangerous or inaccessible for human divers.

The largest and most powerful of these vehicles are work-class and heavy work-class ROVs, which are often used in tasks such as subsea construction as well as inspection, repair, and maintenance (IRM).

These vehicles predominantly utilize hydraulic power for their thrusters, manipulators, and auxiliary tooling. An onboard hydraulic power unit (HPU) provides the necessary power, typically in the 100-hp to 250-hp range.

While hydraulics still dominate, a growing interest in electric work-class ROVs is starting to reshape the seascape, offering improved efficiency, precision, and reliability. These electric systems aren’t poised to replace hydraulics entirely — at least not anytime soon — but they could carve out a growing niche in subsea operations, signaling a shift toward smarter, more efficient underwater tools, and potentially, wider adoption of subsea-resident vehicles.

FLIGHT CONTROL

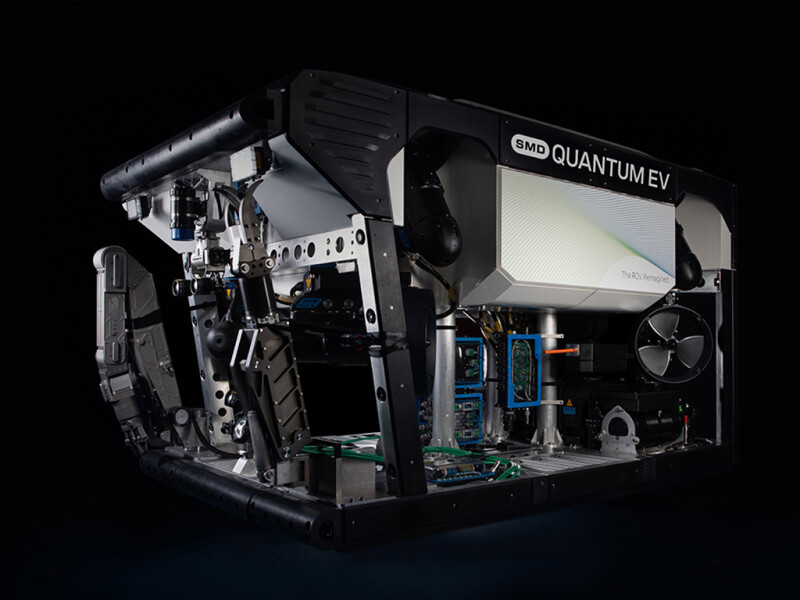

Electric propulsion is faster acting and provides greater controllability, said Mark Collins, director of innovation at SMD, Wallsend, England. In 2019, the company announced plans to introduce its 268-hp Quantum EV, and in 2022, the 10’10″x5’11″x6’3″ electric work-class ROV began in-water testing. Trials wrapped up earlier this year, and five units have been sold to customers in Europe, the Middle East, and the Asia-Pacific, including the first to marine contractor Jan De Nul Group, Capellen, Luxembourg.

Another electric work-class option from SMD is the more compact 8’6″x4’11″x5’1″ Atom EV, which provides 135 hp and is geared more toward data-gathering applications. Both the Atom EV and Quantum EV are rated for water depths of 10,000′, with optional upgrades available for 13,000′ or 20,000′.

Operating an electric ROV is largely the same as a hydraulic vehicle, but the advanced technology makes it easier to use, said Collins.

“The control you have with an electric propulsion module is quite incredible,” he explained. “And with that controllability, you can start to do a lot of clever things. The vehicle stability can be vastly improved because it can hold station with much more accuracy, provided it has complementary flight control computers.”

While flight control systems and auto-functions can be added to hydraulic ROVs, their response time is significantly slower than that of electric vehicles, Collins continued. “So if you’re getting into a situation where you’re trying to hold station in a three-knot current, or something pretty high like that, the hydraulic vehicles won’t be able to do that very easily… which makes it really difficult for the pilots to undertake work in those environments.”

Because electric vehicles can better manage their own stability and flight characteristics, automatically correcting as needed, control can be shifted from manual joystick input to more intuitive, point-and-click operation.

With a highly stable machine and an onboard flight control processor, ROV pilots can use “set point control” — simply tell the vehicle what to do (e.g., “go forward”), and it will maintain that course regardless of currents or other conditions, said Collins. Additional features like waypoint navigation can also be layered in: “Go to this position and report when you arrive.”

While some might refer to this as “de-skilling”, SMD sees it as enabling consistent performance from a broader range of operators, said Collins. Instead of relying on top-tier pilots, clients can now expect the same output regardless of who’s operating the vehicle. “What we’re trying to do is say that anybody who gets their hands on these new vehicles will get the same results, and that’s really good for our clients,” he said.

Other companies with electric work-class ROVs (eWROV) include Saipem S.p.A., Milan, whose 9’2″x5’11″x6’3″ Hydrone-W is rated to 10,000′ water depth (13,000′ optional), provides 200 hp, and has been deployed to support offshore projects for large energy companies such as Equinor ASA, Stavanger, Norway; Shell plc, London; and Petróleo Brasileiro SA, Rio de Janeiro. Another manufacturer, Saab AB, Stockholm, has developed the 9’4″x5’11″x6’3″ Seaeye SR20 eWROV, which is rated to 10,000′ water depth (16,000′ optional) and delivers 241 hp.

THRUSTPOWER

Oceaneering International Inc., Houston, has been offering electric ROVs for many years, starting with a pair of 8’6″x5’x6′ eMagnum vehicles, the first of which was deployed in 2002. The next to come along was the 8’6″x5’x6′ work-class vehicle, eNovus, which is rated to 16,500′ water depth and features a 235-hp power system. Two eNovus systems have been in operation since 2018, amassing a total of 50,000 dive hours.

Today, as Oceaneering is gearing up to debut its next generation of underwater vehicles, the company aims to leverage the benefits of electrification.

“When you convert electricity, send it down the cable, down the umbilical and tether to the ROV, put it into a transformer, operate an electric motor, spin a pump, run an HPU, pump that fluid around the vehicle to spin thrusters, around 30 percent of the power at surface gets turned into thrust at the ROV,” said Nicholas Rouge, subsea robotics product manager at Oceaneering. “When we make that whole system electric, eliminating the hydraulics, we get around 60 to 65 percent efficiency.”

Deployed off a vessel in the North Sea, a dedicated launch and recovery system prepares to launch the Liberty short-term resident system, which is paired with an eNovus ROV. Oceaneering photo.

This translates to more thrust on the ROV itself. During trials, Oceaneering’s engineers had so much more power than expected they had to add extra weight to the vehicle to hold it in place during thruster testing.

In addition, because the ROV draws significantly less power from the vessel or rig it is tethered to, less fuel is burned, and the vessel’s carbon footprint shrinks.

Another environmental benefit, said Rouge, is that the volume of pressurized hydraulic oil and the number of leak points on the ROV are reduced. “We use environmentally friendly fluids, but still, if you have an unplanned leak of any fluid to the environment, depending on where you are in the world, you have to report that to the government. And that goes against your rating when you come up to contracting for future projects,” he said.

Both Collins and Rouge said their companies’ electric ROVs are still offered with hydraulic packs to cater to legacy equipment.

“Our clients have a lot of older manipulators or tools; they don’t want to just throw them in the bin,” said Collins. “And some electric tools aren’t quite available yet, so the vehicle does have the ability to run hydraulics from a very small pack that’s on the machine.

“We’ve managed to get the size of the hydraulic pack down, but the power out of the pack is still very high, because we’re using new technologies like permanent magnet motors and DC power.”

That hydraulic power system can be removed as the shift toward electric tooling takes place. “We’re seeing in the market that more electric tools are starting to come out, and they’ll just plug directly into the vehicle,” said Collins.

MARKET UPTAKE

In 2020, Oceaneering began developing another electric work-class vehicle, which entered the test tank as a prototype in 2024. “Between January 1 and the end of June, we have 600 hours of operation in the test tank,” said Rouge.

The first production vehicle will be delivered into the company’s operations in October or November. “It will go to work from an Oceaneering-chartered vessel [doing IRM work] in the Gulf of Mexico, so that we can build a track record on that vehicle in the field,” said Rouge. “And then we have at least two more vehicles coming in late Q1 of 2026.”

“Beyond that, it all depends on market uptake. So if we have a large number of customers who want electric work-class ROVs, and their operations justify the premium, we will bring more into our fleet.”

Oceaneering doesn’t sell its electric work-class vehicles. Instead, customers pay for the service. Rouge noted that it’s difficult to directly compare costs with a hydraulic vehicle, but the electric ROV service will come with a daily premium. Capital expenditure is higher, he said, but “we’re going to save money on the maintenance, we’re going to save on troubleshooting, and we’re going to be in operations more.”

Collins said SMD’s electric ROVs cost roughly 10% to 15% more than hydraulic equivalents — for now. “We expect that as the adoption of the technology grows, the costs will start to come down to parity, or even less than, because the whole world is electrifying,” he said, referencing the ability to translate components and knowledge from other industries into the offshore sector.

Ultimately, the market is driving demand for greener, more efficient technologies, said Collins, as companies seek to reduce pollution and power use while improving performance. He added that cost pressures and tight working windows, especially in challenging environments, are further accelerating this push. “It’s like a three-dimensional value map,” said Collins, where electric ROV technology can “help customers lower the cost, do jobs faster, and do things better.”

LIVING SUBSEA

While hydraulic ROVs typically require maintenance daily or at least every few days, Rouge said that electric ROVs are more reliable and can remain underwater for longer periods, extending dive durations and opening the door to the next phase for work-class ROVs: subsea residency.

Subsea residency refers to the ability of underwater vehicles to remain deployed on the seafloor for extended periods without needing to return to the surface. This enables continuous underwater operations, reducing launch and recovery costs and improving efficiency.

IKM Subsea AS, Bryne, Norway, claims it is the first company to successfully demonstrate a subsea resident ROV. It has had a 8’2″x4’11″x4’11” Merlin UCV (ultra-compact vehicle), rated to 10,000′ water depths, operating for Equinor in the North Sea since 2018.

Oceaneering has a subsea-resident ROV, too. “Any solution like that, short- or long-term resident, absolutely will be an electric vehicle,” Rouge said. “We’re going toward 30 days with no touch maintenance… That’s the key. Electrification gets us there.”

Of Oceaneering’s two eNovus ROVs in operation today, one is deployed in a standard drilling operation, and the other is the short-term resident Liberty system that deploys throughout the Norwegian Continental Shelf for Equinor, both in the North Sea.

“[The Liberty vehicle] has its own cage with batteries that deploys to the seabed, and it deploys a buoy to the surface that provides communications back to shore. The vessel then is able to perform other functions without staying on location while the ROV is working,” said Rouge.

Instead, the ROV is piloted from one of Oceaneering’s onshore remote operations centers, located in Stavanger, which, according to Rouge, is an important piece of what makes electric ROVs appealing. “Uncrewed surface vessels, residency, and remote operations are going to push the industry toward electric,” he said.

“I don’t know what the uptake is going to be, to be honest. We will not replace our entire fleet in the next 10 years. We will target operations and customers that see the value proposition over the next 10 years, and maybe the electric vehicles account for 50% of our fleet in that timeframe; it could be 25%, it could be 75%. That’s really going to depend on how well these vehicles realize their benefits.”